After Robinhood Shares Collapsed 87% from Peak and 70% from IPO, Goldman Sachs, IPO

It would be funny – if it weren’t so serious – how this stuff is imploding, and Wall Street, which created it, is now washing its hands of it.

By Wolf Richter for WOLF STREET.

Back in December 2020, Robinhood Markets selected Goldman Sachs and JP Morgan as the lead underwriters for its IPO. Then on August 3, 2021, just eight months ago, Robinhood went public at an IPO price of $38 a share, giving the company a valuation of $32 billion, amid enormous hoopla. The lead underwriter’s job is to create this hoopla and create demand for the shares at ridiculous valuations, and they did a great job at that. It came amid the meme-stock trading mania that Robinhood catered to, and crypto trading that Robinhood was getting into.

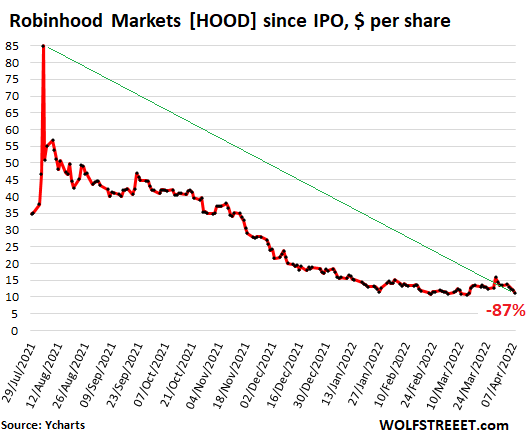

But on the first day of trading, July 29, 2021, shares closed below the IPO price. Over the next few days, the stock meandered higher, and on August 4, it spiked for a moment in an incredible meme-stock paroxysm to $80 a share, and that was it.

The collapse of the share price over those eight months has been spectacular, right there with the collapse of the EV SPACS and other creatures of our time. The shares are now down 87% from the high and are down 70% from the IPO price (data via YCharts):

And this is the moment, after the stock collapsed by 87% from its high and mauled nearly every retail investor that touched these misbegotten shares since August 3, that Goldman Sachs with its usual impeccable timing cut its rating to “sell” from “neutral” and cut the price target to $13 a share.

Goldman analyst William Nance cited the “fading retail engagement” and ongoing weakness in account growth and fading hopes for profitability.

In 2021, Robinhood had a net loss of $3.7 billion, on $1.8 billion in revenues. Which was fascinating – how a brokerage platform could generate such huge losses of twice its revenues during some of the craziest stock and crypto trading ever.

Robinhood is unlikely to become profitable in 2023, based on current trends and headwinds, Nance said. “We believe this lack of clarity around the path to profitability will prevent the stock from re-rating higher.” A “key requirement” for the shares to re-rate higher, such as an upgrade to neutral, or whatever, Goldman would need to “see an acceleration in user growth.”

So user growth is “depressed,” and it could take longer to get to profitability, if ever, and that’s suddenly the problem for Goldman, not the $3.7 billion loss last year, or the ridiculously high pump-and-dump IPO price just eight months ago.

Robinhood tried to boost growth by announcing in March that it would extend its trading hours and eventually would introduce 24-hour trading. But trading isn’t fun unless the stuff being traded goes up. And many of the stocks being traded by enthusiastic meme traders and working-from-homers between Zoom meetings and actual work has formed the now vast body of imploded stocks, including Zoom itself, which has collapsed by 75%, and Robinhood which has collapsed by 87%.

It would be funny – if it weren’t so serious – how this stuff is imploding, and Wall Street, which created it, is now washing its hands of it.

While Robinhood’s cryptocurrency trading has “much better” economics, Nance wrote, the recent decline in trading volumes is a problem.

Why sure. It’s not fun trading cryptos either when cryptos are getting beaten up. Bitcoin at the moment is down 26% year-over-year and down 36% from the November high. Crypto trading is only fun when this stuff goes up. And fun is what the Robinhood platform is all about. Plow your stimulus checks and PPP loans into trading meme stocks and cryptos and have a huge amount of fun becoming a multi-millionaire in no time.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Read More:After Robinhood Shares Collapsed 87% from Peak and 70% from IPO, Goldman Sachs, IPO