‘So bad, it’s good.’ This beleaguered stock market has one big asset on its side, say

A rough month for stocks is drawing to a close, and many investors likely won’t be sad to see the back of it. And the last day of April trade is looking weak as Apple and Amazon failed to raise the bar on a mixed season for tech earnings.

Our call of the day comes from Keith Lerner, chief market strategist at Truist Advisory Services, who said “depressed” investor sentiment is the reason he hasn’t shifted to a full negative stance on stocks right now.

“Indeed with markets, it’s not about good or bad — it’s all about better or worse relative to expectations. When expectations are low, a little bit of good news can go a long way. That’s why markets tend to bottom when fear and uncertainty are at an extreme,” said Lerner in a recent note to clients.

He downgraded his equity stance to neutral in April after two years of a positive stance, noting that while the range of potential outcomes is wide, risk/reward is less positive.

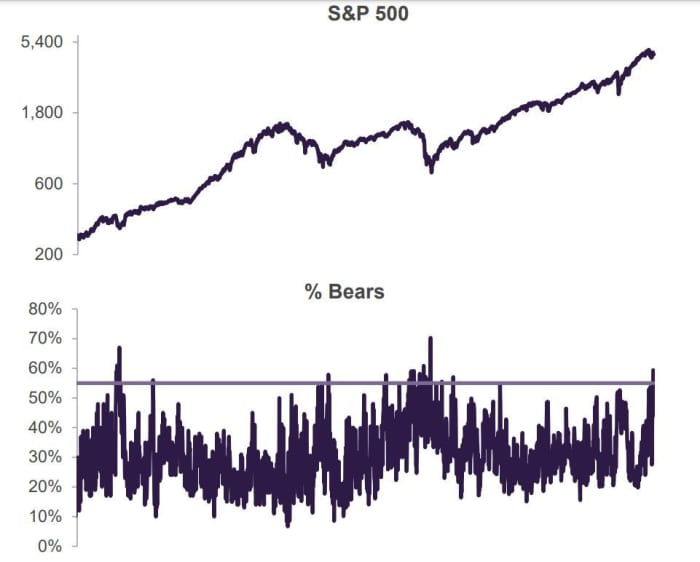

He pointed to the latest survey from the American Association of Individual Investors (AAII), which showed the percentage of investors with a negative/bearish outlook surging to 59.4%. That was the highest since early March 2009, just a few weeks short of a major stock bottom following the 2008-09 financial crisis decline.

“To be fair, investors were correctly negative in January 2008 in the early stages of that market downturn,” he said.

The percentage of bullish investors is currently 16%, also close to a record low, leaving the bull/bear spread at -43%, a level that has been surpassed twice in the past 35 years — in the fall of 1990 and that March 2009 period, said Lerner.

Truist Advisory Services

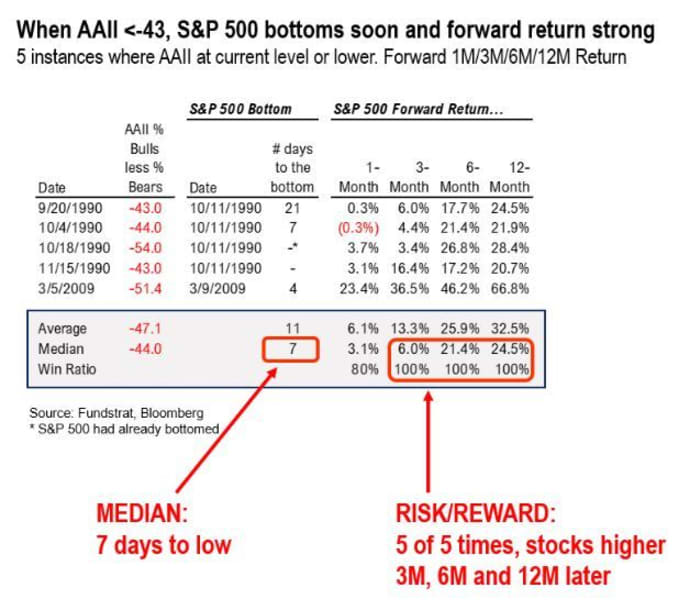

A similar theme was heard from Thomas Lee, founder of Fundstrat Global Advisors, who told clients that the AAII sentiment survey was a “major bottom signal,” based on history. “So bad, it’s good,” he said.

Lee provided this chart showing when such a weak reading marked a stock bottom:

One footnote from Lee is that the AAII survey tends to sample older investors, and not the Reddit crowd.

Read: Boomers are leaving the stock market. Here’s what happens next.

Lerner adds other proof of investor negativity, such as the $45 billion flowing out of equity funds over the past two weeks. “This is an extreme that we have also seen during times of heightened uncertainty and volatility,” Lerner said.

For example: the post-Lehman Brothers bankruptcy, the U.S. debt downgrade, COVID-19 pandemic lows and two months before the 2020 U.S. presidential election. While the Lehman Brothers signal was “premature,” strong price returns followed the other periods, he said.

In short, Lerner said Truist follows the “weight-of-the-evidence approach,” which is telling it that depressed investor views and a “low hurdle for positive surprises” are the stock market’s biggest assets going.

The buzz

The Federal Reserve’s favored inflation gauge — the core personal consumer expenditure price index — rose a sharp 0.9%i, and employment costs also rose. The followed by the University of Michigan consumer sentiment index is still to come, and next week we’ll get a Fed meeting.

Amazon

AMZN,

is down 8% in premarket after its first loss in seven years. Apple

AAPL,

is down over 2% after the tech giant topped earnings and set a revenue record, but warned of billions in added costs from supply-chain woes.

Tesla

TSLA,

stock is higher after CEO Elon Musk tweeted that there were no more sales planned for now, after he sold nearly $4 billion worth.

Earnings from Chevron

CVX,

Exxon

XOM,

have left those shares softer, while Honeywell

HON,

is up on results, while AbbVie

ABBV,

Bristol-Myers Squibb

BMY,

and Colgate-Palmolive

CL,

are also all down on results.

Opinion: Big Tech is no longer winning as big, but these two stocks still seem safe

Elsewhere, Intel

INTC,

is down after results, while investors…

Read More:‘So bad, it’s good.’ This beleaguered stock market has one big asset on its side, say